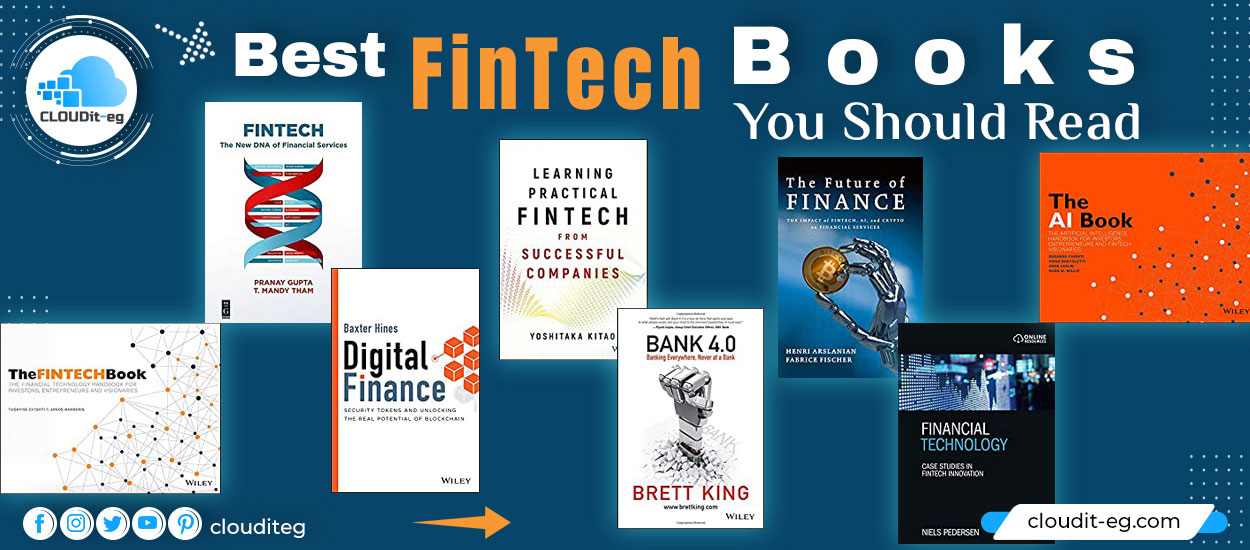

Fintech is a portmanteau of the terms “finance” and “technology” and refers to any company that develops innovative digital technology to optimize a financial service. In this comparison, we present to you the Best FinTech Books You Should Read.

1. Learning Practical FinTech from Successful Companies 1st Edition

by Yoshitaka Kitao | May 11, 2018

From the Inside Flap

The financial industry is taking a major step forward in the evolution of FinTech on a scale that will redefine the most basic assumptions about how we live. In the same way, the Internet and smartphones did. Financial services providers must already be preparing for the population-wide adaptation of FinTech 2.0 And Learning Practical FinTech from Successful Companies opens up an insider’s view of how today’s most disruptive thought leaders are shaping and predicting the next ways we manage wealth.

The esteemed Yoshitaka Kitao, CEO of SBI Holdings, leads an impressive group of contributing writers in sharing their personal experiences at the forward-edge of FinTech, including in-depth discussions on the various types of technologies driving the industry. Since the SBI Group first put financial services on the Internet by offering online banking, securities, and insurance, there have been continual advancements in offering more convenience to customers through technology. Artificial intelligence (AI), big data, the Internet of Things (IoT), and robotics have all served to further those goals by sharing data, and now blockchain technology makes it possible to exchange value anywhere in the world over the Internet. Inside, see firsthand why financial institutions need to get ahead of blockchain to stay relevant and survive in tomorrow’s reality.

This brilliantly designed guide offers unmatched value in the real world by providing:

- Personal accounts of the conception and strategic operations of some of the most innovative financial organizations responsible for the way wealth is managed today

- High-level insights into blockchain explained in practical terms, including why low-value, high- frequency payments can be settled at a fraction of traditional costs

- An up-to-date exploration of Robo-advisory services that illustrates how they’re changing the fundamental purpose of wealth managers

Customers are attracted and loyal to financial services firms that give them what they want, and Learning Practical FinTech from Successful Companies shows you how to bring them to you.

2. Fintech: The New DNA of Financial Services

by Pranay Gupta, T. Mandy Tham | Nov 19, 2018

This extraordinary book, written by leading players in a burgeoning technology revolution, is about the merger of finance and technology (fintech), and covers its various aspects and how they impact each discipline within the financial services industry. It is an honest and direct analysis of where each segment of financial services will stand.

Fintech: The New DNA of Financial Services

It provides an in-depth introduction to understanding the various areas of fintech and terminology such as A.I., Big Data, Robo-advisory, Blockchain, Cryptocurrency, Insuretech, Cloud computing, Crowdfunding, and many more. Contributions from fintech innovators discuss banking, insurance, and investment management applications, as well as the legal and human resource implications of fintech in the future.

Fintech will bring revolutionary change to the finance and investment industry within the next decade, on the same scale as the internet did to the retail industry. There will be disruptors and the disrupted, startups which will become behemoths and incumbents which will need to adapt. Understanding this evolution is paramount, no matter what field you are in. This book is readable by every industry professional, every college and high school student, and the common man, as we focus on explaining concepts and terminologies in-depth while refraining from using any programming or mathematics.

3. The FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries

by Susanne Chishti, Janos Barberis | May 2, 2016

A front-line industry insider’s look at the financial technology explosion

The FINTECH Book is your primary guide to the financial technology revolution and the disruption, innovation, and opportunity therein. Written by prominent thought leaders in the global fintech investment space, this book aggregates diverse industry expertise into a single informative volume to provide entrepreneurs, bankers, and investors with the answers they need to capitalize on this lucrative market. Key industry developments are explained in detail, and critical insights from cutting-edge practitioners offer first-hand information and lessons learned.

The financial technology sector is booming, and entrepreneurs, bankers, consultants, investors, and asset managers are scrambling for more information: Who are the key players? What’s driving the explosive growth? What are the risks? This book collates insights, knowledge, and guidance from industry experts to provide the answers to these questions and more.

- Get up to speed on the latest industry developments

- Grasp the market dynamics of the ‘fintech revolution’

- Realize the sector’s potential and impact on related industries

- Gain expert insight on investment and entrepreneurial opportunities

The fintech market captured over US$14 billion in 2014, a three-fold increase from the previous year. New startups are popping up at an increasing pace, and large banks and insurance companies are being pushed toward increasing digital operations in order to survive. The financial technology sector is booming and The FINTECH Book is the first crowd-sourced book on the subject globally, making it an invaluable source of information for anybody working in or interested in this space.

4. Financial Technology: Case Studies in Fintech Innovation 1st Edition

by Niels Pedersen | December 29, 2020

With the continued success of fintech (financial technology) businesses around the world, financial services are becoming increasingly decentralized, personalized, and automated. This new textbook strikes a balance between academic depth and commercial relevance in examining the advantages and challenges of these changes through the lens of various analytical frameworks.

Financial Technology demystifies key technologies, such as blockchains, the Internet of Things, AI, machine learning, and algorithmic data analysis, in a clear and accessible style suitable for readers with no technological background.

Real-world case studies from a variety of international organizations including HSBC, ING, Amex, AIG, IBM, Tandem, and Monzo. Bridge the gap between theory and practice and contextualize learning in terms of real businesses, from large incumbents to smaller start-ups. With coverage of Robo-advisors, mobile-only banks, open banking, and risk and regulation. This book also explores a range of analytical frameworks to critically examine new technologies and emerging business models.

Financial Technology enables readers to understand the fintech movement in the context of recent financial history, examine the key drivers of change, and form insights about the financial system in a forward-looking and global manner. Online resources include PowerPoint slides for lecturers, video lectures, a literature review, and blog posts to cover industry developments.

5. Digital Finance: Security Tokens and Unlocking the Real Potential of Blockchain

by Baxter Hines | Dec 3, 2020

Praise for Digital Finance

“Digital Finance was helpful in articulating questions the reader potentially didn’t know they needed to ask. Hines explains complex terms in a way that is digestible for anyone with a basic business background. The conceptual explanations were also concise and intentional, covering just what I wanted to know to have a solid understanding of a tokenized ecosystem and why there may be advantages found in decentralized finance vs. traditional lending.”

―Kathryn Carlisle,

Senior Managing Director, Blockchain Center for Excellence, University of Arkansas

“Baxter does a terrific job explaining the revolutionary technologies that are affecting the financial industry and show just how transformational those will be in the coming wave of digital finance. This book is a must for those who want a better understanding of how blockchain is going to improve the financial industry.”

―Jake Ryan,

author, Crypto Asset Investing in the Age of Autonomy; CIO, Tradecraft Capital

“Digital Finance provides a comprehensive review of the security token marketplace and provides a powerful vision of what to expect in the coming years as blockchain transforms finance. The chapter on DeFi points to a massive emerging market as the transaction efficiency of security tokens meets the scale and transparency of Defi self-processing assets―the true antidote to prevent a repeat of the 2008 Global Financial Crisis. This book is perfect for the blockchain novice or expert with straightforward examples to support a thorough analysis of the rapidly evolving digital finance market.”

―Dan Doney,

Chief Executive Officer, Securrency

“Educate yourselves on the future of finance! Digital tokenization of securities is bringing in new investors and issuers, democratizing access to capital. Baxter’s book is a must-read for anyone who wants to get ahead of the curve.”

―Spencer Dinwiddie,

NBA All-Star; Founder, DREAM Fan Shares

“Don’t let complicated words like blockchain and tokens prevent you from learning about the future of finance. Capital markets are being transformed right before our eyes. And Baxter details exactly how that is happening on a molecular level.”

―Kyle Sonlin,

host, The Security Token Show

6. The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial Services

by Henri Arslanian, Fabrice Fischer | July 24, 2019

This book, written jointly by an engineer and artificial intelligence expert along with a lawyer and banker, is a glimpse of what the future of financial services will look like and the impact it will have on society.

The first half of the book provides a detailed yet easy-to-understand educational and technical overview of FinTech, artificial intelligence, and cryptocurrencies. It including the existing industry pain points and the new technological enablers.

The second half provides a practical, concise, and engaging overview of their latest trends. And their impact on the future of the financial services industry including numerous use cases and practical examples.

The book is a must-read for any professional currently working in finance, any student studying the topic, or anyone curious about how the future of finance will look like.

7. Bank 4.0: Banking Everywhere, Never at a Bank 1st Edition

by Brett King | July 24, 2019

Winner of the best book by a foreign author (2019) at the Business Book of the Year Award organized by PwC Russia

The future of banking is already here ― are you ready?

Bank 4.0 explores the radical transformation already taking place in banking and follows it to its logical conclusion. What will banking look like in 30 years? 50 years? The world’s best banks have been forced to adapt to changing consumer behaviors; regulators are rethinking friction, licensing, and regulation; Fintech start-ups and tech giants are redefining how banking fits in the daily life of consumers. To survive, banks are having to develop new capabilities, new jobs, and new skills. The future of banking is not just about new thinking around value stores, payment, and credit utility.

It’s embedded in voice-based smart assistants like Alexa and Siri and soon smart glasses which will guide you on daily spending and money decisions. The coming Bank 4.0 era is one where either your bank is embedded in your world via tech, or it no longer exists.

In this final volume in Brett King’s BANK series,

we explore the future of banks amidst the evolution of technology and discover a revolution already at work. From re-engineered banking systems to selfie-pay and self-driving cars, Bank 4.0 proves that we’re not on Wall Street anymore.

Bank 4.0 will help you:

- Understand the historical precedents that flag a fundamental rethinking in banking

- Discover low-friction, technology experiences that undermine the products we sell today

- Think through the evolution of identity, value, and assets as cash and cards become obsolete

- Learn how Fintech and tech “disruptors” are using behavior, psychology, and technology to reshape the economics of banking

- Examine the ways in which blockchain, A.I., augmented reality and other leading-edge tech are the real building blocks of the future of banking systems

If you look at individual technologies or startups disrupting the space, you might miss the biggest signposts to the future. And you might also miss that most of what we’ve learned about banking the last 700 years just isn’t useful.

When the biggest bank in the world isn’t any of the names you’d expect. When branch networks are a burden, not an asset, and when advice is the domain of Artificial Intelligence. We may very well have to start from scratch. Bank 4.0 takes you to a world where banking will be instant, smart, and ubiquitous. And where you’ll have to adapt faster than ever before just to survive. Welcome to the future.

8. The AI Book: The Artificial Intelligence Handbook for Investors, Entrepreneurs and FinTech Visionaries 1st Edition

by Susanne Chishti, Ivana Bartoletti, Anne Leslie, Shân M. Millie | April 20, 2017

Written by prominent thought leaders in the global fintech space, The AI Book aggregates diverse expertise into a single, informative volume and explains what artificial intelligence really means and how it can be used across financial services today. Key industry developments are explained in detail, and critical insights from cutting-edge practitioners offer first-hand information and lessons learned.

Coverage includes:

- Understanding the AI Portfolio: from machine learning to chatbots, to natural language processing (NLP); a deep dive into the Machine Intelligence Landscape; essentials on core technologies, rethinking enterprise, rethinking industries, rethinking humans; quantum computing and next-generation AI

- AI experimentation and embedded usage, and the change in the business model, value proposition, organisation, customer and co-worker experiences in today’s Financial Services Industry

- The future state of financial services and capital markets – what’s next for the real-world implementation of AITech?

- The innovating customer: users are not waiting for the financial services industry to work out how AI can re-shape their sector, profitability, and competitiveness

- Boardroom issues created and magnified by AI trends, including conduct, regulation & oversight in an ego-driven world, cybersecurity, diversity & inclusion, data privacy, the ‘unbundled corporation’ & the future of work, social responsibility, sustainability, and the new leadership imperatives

- Ethical considerations of deploying Al solutions and why explainable Al is so important.