What is Fintech? Mobile payments, open banking, blockchain, crypto-currencies, RegTech, InsurTech … The world of finance is complex and particularly conducive to new buzzwords and concepts that challenge our knowledge of the sector. This is why we have chosen to focus on a very specific theme today: FinTech. Definition, examples, numbers, and more await you!

DEFINITION

A small definition is in order: FinTech is a contraction of two terms, Financial Technology. Although the term has been around since the 1980s, it was not until the global financial crisis of 2007-2008 that some groups began to use the term in a professional context. Following a global boom (an exponential growth in the number of projects and funding dedicated to the sector) in 2012, the expression became popular with the general public in 2015.

In general, the term refers to companies in the financial sector (start-ups, in particular) that deploy new technologies to provide financial services more efficiently and often at a lower cost.

This often disruptive approach places the FinTech sector in direct competition with traditional financial services which, being often large companies, have more difficulty in adapting and rapidly deploying new technologies within their structures.

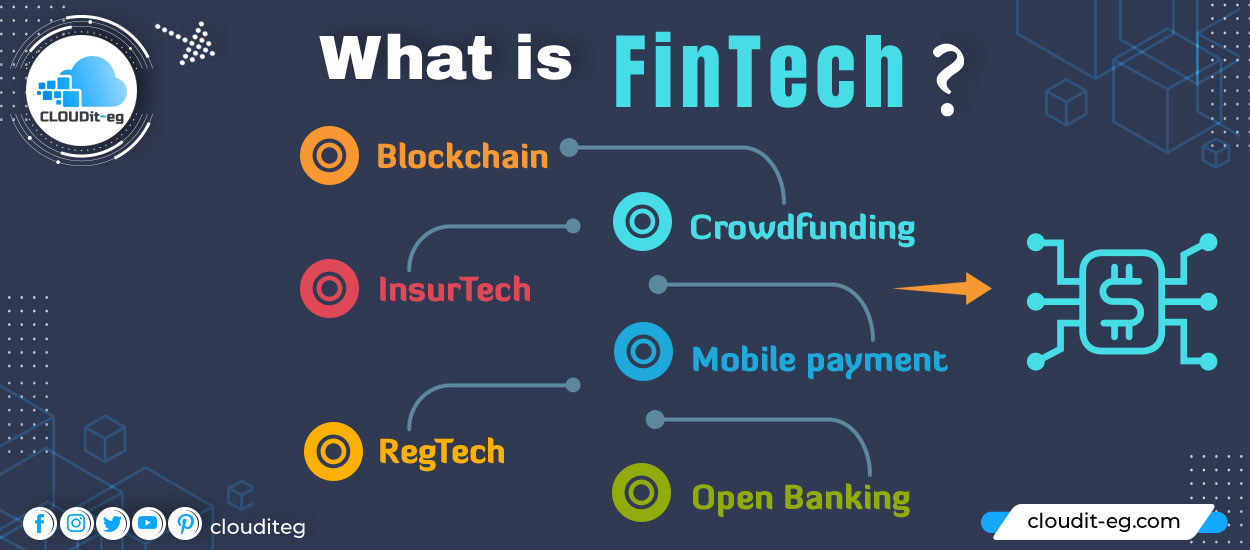

These new technologies take many forms and respond to existing or emerging issues in the finance sector. You will certainly recognize some of these technologies (at least in the name) …

WHAT TECHNOLOGIES IN FINTECH?

The following list is far from exhaustive due to the constant evolution of the sector and the development of new technologies until then untapped. It does, however, bring together some of the major technologies that have had the greatest impact on the financial sector as a whole.

- Blockchain / cryptocurrencies

How could we make a dossier on FinTech without presenting the technology which has succeeded more than any other in giving a cold sweat to the global economy? While the surge in cryptocurrency prices is a distant memory today, these virtual currencies and the Blockchain technology they rely on remain relevant in many FinTechs today. For those of you who do not know Blockchain or cryptocurrency, we invite you to discover our thematic file Understanding Blockchain and Cryptocurrency which deals with the subject in detail.

- Crowdfunding

A pioneer of FinTech just like cryptocurrencies, crowdfunding has been around for several centuries, but went digital around the same time as cryptocurrency (2008 – 2009), opening the doors to forms of alternative financing that did not go through the traditional channels such as banks. Just like Blockchain and cryptocurrencies, crowdfunding is a subject far too vast to explain in a few lines;

- Instant Pay / Mobile payment / …

Payment methods are evolving rapidly today; this is the case in particular with Instant Pay, a money transfer method that disrupts the long-held notion that payment must take 2 to 5 days to be validated by a bank (although the latter have begun to integrate this practice into their structures). There are also other innovative payment methods that are starting to make a splash, such as mobile payment (like Apple Pay) which challenges the notion of using cash or a bank card in a store to make a purchase.

- Open Banking

Literally translated as an open banking management/system, Open Banking is a relatively recent practice in the banking sector which calls into question several fundamental concepts of the system (in particular, the confidentiality and retention of bank data within a single structure). Open Banking applies a more open approach which allows certain banking data to be shared between a bank and certain third-party financial services. This practice is of course strictly regulated and does not apply unconditionally, and several banks express a certain distrust of the practice of Open Banking. However, this practice attempts to revolutionize the traditional system; some even see it as a parallel with how big data has revolutionized the marketing industry.

- RegTech

As you may have already known, FinTech is not the only (name) Tech to have developed over the last decade. In the case of Regtechs, the latter have developed in addition to FinTechs. A contraction of the English words “Regulatory” and “Technology”, RegTechs is part of a logic of better management of regulation for the financial sector.

- InsurTech / AssurTech

“Insurance / Assurance” and “Technology” are contracting to form this particular sector which, like the financial sector with which it is close, is disrupting certain traditional insurance practices.

FINTECH: WHAT FUTURE?

We told you at the beginning of the file: FinTechs have experienced a meteoric boom since 2012 (figures to which we will come back later), and continue to have undeniable traction in the finance sector. In particular, there are two countries that stand out as leaders in FinTechs: the United States and the United Kingdom, which have benefited from numerous investments.

The other two FinTech “capitals” in Europe are currently Stockholm and Amsterdam. France, for its part, is a little behind following a late boom in 2014 of French-speaking start-ups specializing in FinTech (there were just over 500 in 2018).

Either way, many are willing to bet that FinTechs have a bright future ahead of them, just like other sectors that are prone to disrupting traditional markets.